Sourcing is just one piece of the puzzle. At Pipelabs, we have developed a framework consisting of 29 individual processes, with sourcing as a part of Pipelining – all things to engage relevant candidates. In this article, we’ll explore our approach to outreach, starting with the importance of internal research before reaching out to potential candidates. Read on to discover how our framework can help you attract the best candidates for your team.

Isn’t sourcing writing boolean strings?

No, it isn’t. Our take is that writing good/excellent/impressive/functional boolean strings is just a tool and never sourcing. Sourcing is a mindset and a process, and this is ours. Of course, many of the steps require a fair amount of writing well-working strings. But that is not where we want to put our emphasis.

The main point we hope to provide is how little sourcing skills are in that area and how much of it is understanding the market, telling a story, and knowing who you’re approaching. The skill set of getting the “right” results from a database using boolean strings is just a skill, not an understanding.

What is our approach when outreaching?

At Pipelabs, we’re slightly obsessive about improving practices and ways of working. When it comes to sourcing, our method might differ somewhat from the approach you’re used to, and we want to share our findings and approach.

Our framework consists of 29 individual processes, where sourcing is one. We place it into Pipelining, a name for all things done to engage relevant candidates. This is also one of the most commonly known parts of talent acquisition and one of the more important ones.

Internal Processes

Internal Processes

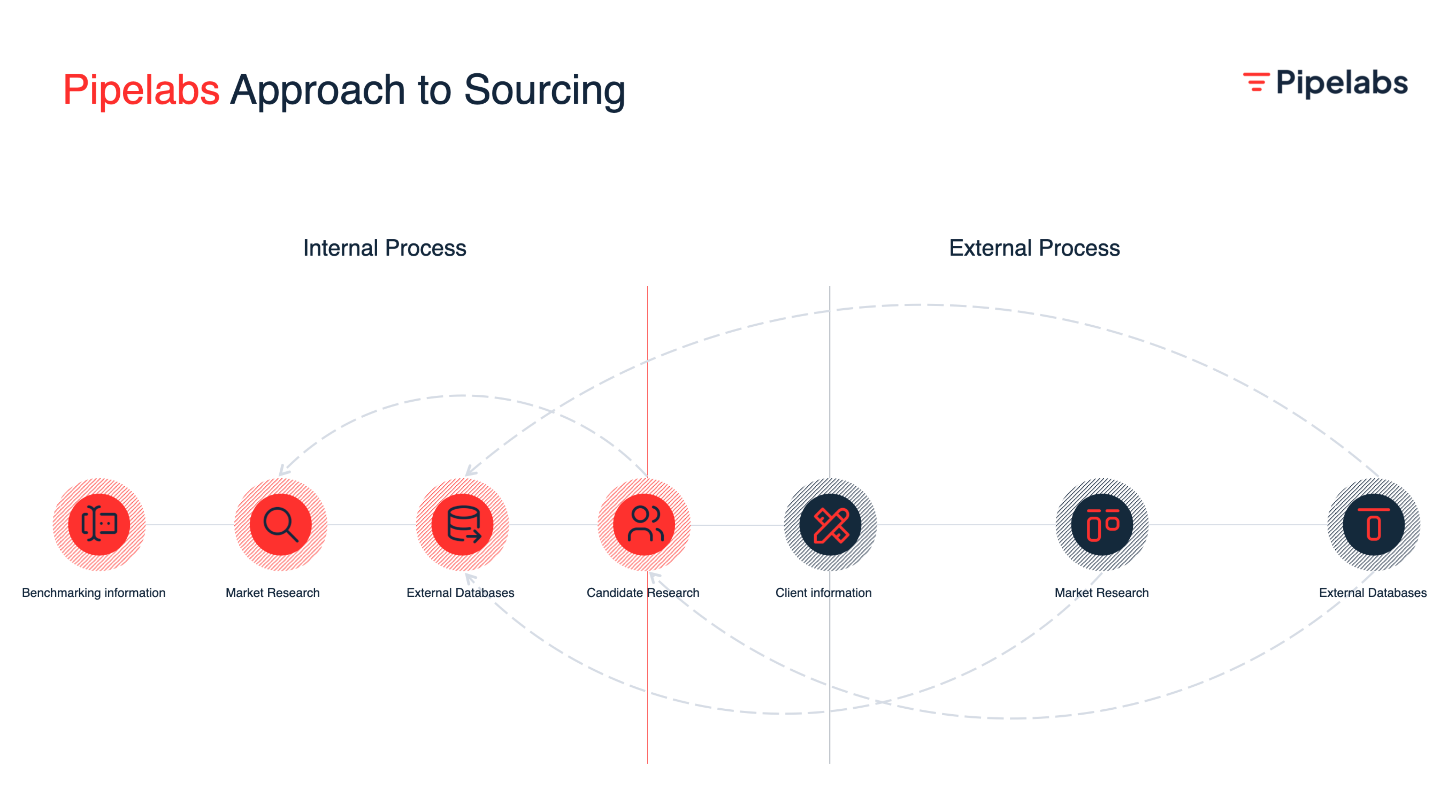

Before reaching out or looking at potential candidates, good sourcing should first focus on understanding the market, talent pool, and circumstances. We call this “Internal Processes” since it has nothing to do with engaging candidates. Here is in what ways this research is essential for Talent Acquisition efforts:

Talent Intelligence

Sourcing Strategy

Industry Trends

1. Benchmarking Information

Some would, and some do, call this “EVP” and ties it closer to employer branding. What it does is it encompasses a lot of different topics where one should benchmark the employer against other employers in the same market.

Company information, cultural insights, way of working, tech stacks, compensation & benefits, and workforce insights is just a few of the relevant parts that should be benchmarked against the potential competitors. Not only to gain insights but also to influence the actual recruitment process. Where can one’s competitive edge be found?

2. Research

- Which are the main competitors for this talent?

- What does the market look like? Which are the other companies that show the same archetypical indicators?

- Which non-traditional talent pools are overlooked with the current approach?

- What is the lowest common denominator for the talent we want to approach?

- Based on the assessment criteria, where could you gain that experience and capabilities?

- What are the key insights from the talent pool, and what conclusions can we draw from that both by extrapolating and inferring information?

3. Secondary Databases

During this phase, there are a lot of tools to identify relevant candidates. Not limited to LinkedIn, we want to stress the importance of leveraging communities on platforms such as Slack, Discord, Behance, portfolios, GitHub, network mapping, and Reddit.

The key takeaway is that you should never rely on one information database like LinkedIn. Our primary goal in this phase is to question the validity of a single source of data and think from which other sources we can try and identify relevant people to contact.

4. Candidate Research

The candidate research process involves identifying and sourcing potential candidates through internal research before interacting with them through various channels. It uses the industry and tech stack insights from previous stages to optimize your search.

This internal research process also involves analyzing the skills and qualifications necessary for the job using secondary data points and identifying potential candidates who are Qualified, Available, and Interested.

During this stage, we recommend narrowing down the cohort not to include more than 6-12 potential candidates that seem to overlap wholly with the needs for that particular role. Working in smaller cohorts allows for quicker iterations, and it will, by definition, force you away from the spray-and-pray approach. And if the previous steps have been done – you will not have to.

And then spend time researching those candidates using the same methodology as above. You never want to try and engage anyone without at least trying to see if the opportunity could overlap with their interest, profile, and current work.

External Processes

Once you have identified potential candidates, the process of candidate interaction begins. Different outreach efforts include personalized messages to potential candidates via LinkedIn Inmail. It also is a digital landing page to communicate with, inform, and attract potential candidates with very low entry barriers. The point is not to send bland messaging to enough people and be lucky. It is all about understanding the current market for the roles you’re working with.

Tools

The specific toolset will vary depending on the exact situation, but a few that consistently provides good results are:

LinkedIn / Inmails

Phone / Texts

Digital landing pages

Tailored content

Intros from other people internally

The first three are just avenues for contacting people identified as potential candidates. Digital landing pages are custom messaging toward a talent pool that would be the equivalent of a job ad (but better). Supplying tailored content isn’t always necessary but a tool that provides excellent value when used correctly.

Process

You should constantly measure the output of your work. When you start the outreach/external phase, consider the first cohort your “A”-data. With that on hand, you have a baseline for comparing changes or adjustments to our efforts.

When moving on from the first cohort, keep the data at hand for the next cohort of an additional 6-12 potential candidates, but this time make a change. Either in which candidates you approach or in the way you approach them. The second cohort is “B”-data, which can be repeated ad nauseum. With short sprints of iteration, you should also see a measurable improvement in your chosen KPIs.

Feedback

The feedback you get from the outreach, in terms of data and anecdotal evidence from the few encompassed in the first cohort, should be used to iterate and improve the output.

Stringent documentation, structure, and small cohorts afford you to work this agile with really short turn-around times.

So what to measure?

Overdoing what is measured usually makes it a barrier to constantly doing it. We would recommend keeping the number of KPIs few and taking the opportunity also to start working more towards attribution collecting. The last part is simply asking all candidates that respond positively, “What made you accept my enter outreach?” and documenting that. You will be shocked at how valuable those insights are over time.

Suggestion for data gathering:

- Response rate (number of accepted outreach/number of sent outreach*100)

- Candidates entered into the process (number of booked interviews/response rate*100)

- Why did you choose to accept my outreach?

Iteration

A set of example questions you should ask yourself during this phase is:

- Did you choose the right people for the first cohort?

- Were our assumptions wrong?

- Was the value proposition not as strong as anticipated?

- Which questions arose – and how can we handle them?

That information should be the basis for your iteration in selecting the second cohort when needed.

“Working with sourcing is mainly a starting position in recruitment, and as long as you can navigate LinkedIn Recruiter and write Boolean Strings, you’re good to go”

– Too many TA Leaders, 2023

This is only a taste of the help we provide to our clients in rethinking how sourcing works. It is one of many processes that will directly impact your success in your talent acquisition efforts. Even if it might seem like a lot, you can quickly do many things that drastically improve quality, shorten process times, increase predictability, and lessen recruitment-related costs.